By Emmanuel Obisue

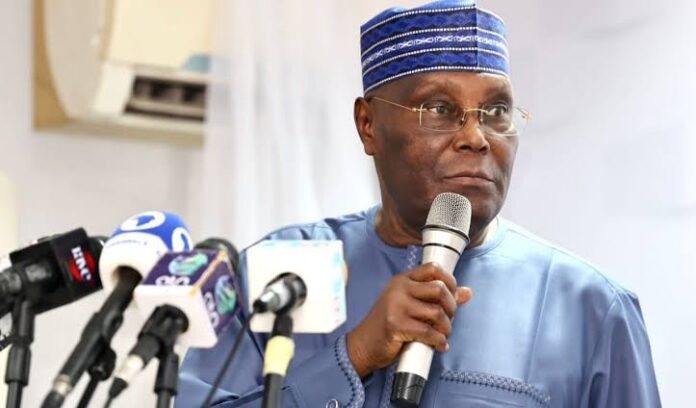

Atiku Abubakar, presidential candidate of Nigeria’s main opposition party- the Peoples Democratic Party, PDP, has promised that within his first 100 days in office, he will create an “Economic Stimulus Fund with an initial investment capacity of approximately US$10 billion to prioritize support to MSMEs across all the economic sectors”.

The former Vice President made this vow on Tuesday in Lagos while reeling out his economic blueprint for Nigeria at the Lagos Chamber of Commerce and Industry, LCCI Economic Forum.

He noted that the private sector is key to any government’s development agenda, and “must be always listened to”, adding that if elected, his administration will incentivise private sector investments to drive sustainable growth and development.

“A warm handshake with the private sector is inevitable for any economic policy or programme to succeed. Indeed, private sector leadership in driving growth is the first of the three key principles of my economic growth and development agenda,” he noted.

Speaking on the underperformance of Nigeria’s energy industry, he reiterated his previous stance of his intent to sell-off refineries to capable private entities. While referencing the N1.5bn set aside by the current administration as a starter pack fund to repair refineries, he decried that so much money has been spent on rehabilitating refineries with zero result.

He added that his administration will take immediate steps to slow down the rate of debt accumulation by promoting more Public Private Partnerships in critical infrastructure funding and identifying more innovative funding options.

“I will not come unprepared. It is not in my character as a businessman or as a public officer to be caught off guard. My policy document contains the right policies that will be timely delivered.

“We will elevate production for export to a top policy priority and long-term investment priority and promote export of manufactured goods.

“We shall incentivize private investors to invest in the development of multiple greenfield mini-grid transmission systems to be looped into the super-grid in the medium to long term while allowing the FG focus on policy, regulation, and standardization,” he added.

He further assured that borrowed funds will be channelled into projects of interest, and ensure that government expenditures does not exceed 45% of national budget.

On insecurity challenges, he said “tough and difficult decisions” will be taken “without fear or favour”. “Investment is a coward animal and is fearful of conflicts and insecurity,” he added.

Speaking on Nigeria’s Infrastructure Master Plan, Atiku noted that the country has an infrastructure financing deficit of approximately US$3trillion over the next 30 years. This he said, means a financing requirement of approximately US$100 billion per annum which cannot be met by the public sector.

“I have a good grasp of the challenges bedeviling Nigeria. I know the root causes of our problems. I know that many of these problems are self-inflicted and can be reversed if we are determined,” the former VP stated.